operates under the brands Folio Investing (online self-directed investing), Folio Institutional (innovative advisor services), and VIA Folio (online private securities distribution and custody). “When they offer these other types of services – face-to-face retail brokerage, for example – many customers will come to their credit union for those services just because of the trust factor. is a self-clearing FINRA broker-dealer and custodian. A Folio is defined as a portfolio of stocks, ETFs, and mutual funds that can be bought and sold as a single order (FOLIOfn allocates the order across all of the holdings in the Folio.) This investment vehicle is very. “Consumers’ trust with their credit unions is very high,” he says. is a company that provides a new type of investment vehicle called Folios to financial advisors. Henry is confident that the folios will catch on at credit unions. The goal is to offer the service through 200 credit unions within six months and more than 500 within two years. “Some of the credit unions are big, but obviously not as big as the largest bank holding companies,” he says.įoliofn’s services, which will be called Members Folio Investing, will be added to the e-commerce side of Members Development, which already has online relationships with 900 credit unions. Henry, also Cuna’s vice president of sales, says that Members Development helps credit unions deliver some of the services that large banks and brokers routinely offer. The repeal effectively lets insurance companies, banks and brokerage companies compete on one another’s turf. “Credit unions have entered this brave new world of financial services,” says John Henry, president and CEO of Members Development, referring to the 1999 repeal of the Glass-Steagall Act of 1933. The partnership with Cuna will also benefit credit unions, which are looking for ways to broaden their offerings to better compete with other financial companies. Folio Institutional supports institutions and more than 420 financial advisor firms nationwide that have billions of dollars in assets on the Folio platform. Website External link for Folio Institutional. Its marquee product, Folio Investing, is pitched as a way to combine the diversification benefits of mutual funds with direct stock ownership while avoiding the high expense ratios and capital gains tax hits of many mutual funds. and FOLIO Research, LLC are separate, wholly owned subsidiaries of FOLIOfn, Inc. Wallman, a former member of the Securities and Exchange Commission.

It will offer Foliofn’s services through Members Development Co., which was formed last year by Cuna, and 37 credit unions to better serve the credit union industry with financial services.įoliofn is headed by Steven M.H.

LLC and subsidiaries of The Goldman Sachs Group, Inc., a worldwide. “It gives the company a way to market its products to a large number of people.”Ĭuna provides financial products such as insurance and brokerage services to about 95% of the nation’s 10,700 credit unions. Folio Financial, Inc., and Folio Investments, Inc. “This is a really smart move for Foliofn,” says Scott Berry, an analyst with Morningstar Inc., the Chicago fund tracker.

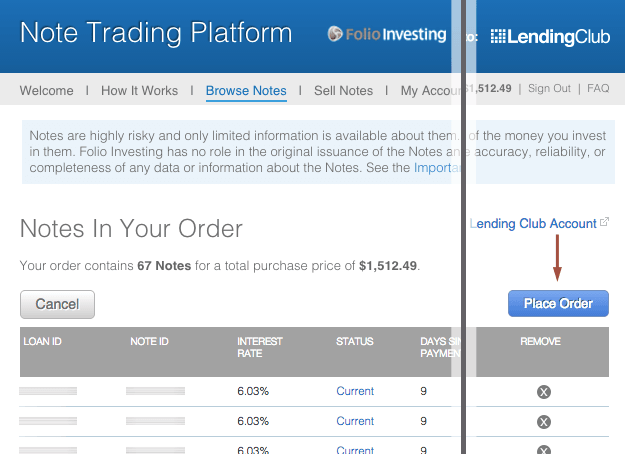

The move will put its services in front of millions of credit union customers. of Vienna, Va., which offers online prefab or custom-made stock portfolios, formed a partnership last month with Cuna Mutual Group of Madison, Wis. To open a Folio Investing account, individual investors may visit Financial advisors may visit to request a demo of Folio’s brokerage and custodian features.Foliofn Inc. is also the parent company of First Affirmative Financial Network, a registered investment advisor specializing in sustainable, responsible, impact (SRI) investing and producer of the SRI Conference, the largest, longest running annual forum for investors and investment professionals engaged in SRI investing. It provides services to some of the world’s largest financial services firms as well as start ups. is a self-clearing FINRA broker-dealer and custodian and operates under the brands Folio Investing, Folio Institutional, and VIA Folio. Folio Investing, also known as FOLIOfn, is an investment platform that provides investing and portfolio management which allows customization as well as tax and. SRG is pleased to announce a new strategic partnership with First Affirmative Financial Network LLC, which is a wholly-owned subsidiary of FOLIOfn, Inc. provide integrated brokerage, custody and technology development services to financial enterprises and investment advisors on both a full-service and technology-licensed basis. and its wholly-owned subsidiary Folio Investments, Inc.

0 kommentar(er)

0 kommentar(er)